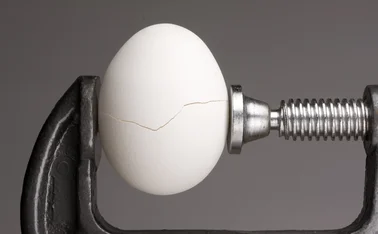

CBDC would not destabilise Italian banks, research finds

But fully anonymous digital currency could increase flight from deposits, Bank of Italy paper says

The eurozone could introduce a retail central bank digital currency (CBDC) without destabilising the Italian banking sector, a Bank of Italy working paper says.

But how it was introduced would determine its impact on banks, argue Simone Auer, Nicola Branzoli, Giuseppe Ferrero, Antonio Ilari, Francesco Palazzo and Edoardo Rainone.

The researchers assess the impact of a CBDC on Italian banks’ funding structures and profitability during “normal times”. They find that the impact would be manageable

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: http://subscriptions.centralbanking.com/subscribe

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@centralbanking.com

Most read

- Artificial intelligence: key questions for financial supervisors

- Risks facing central banks: action and inaction

- Central bank of the year: Central Bank of Brazil