Hedge funds may reduce liquidity in volatile periods – BoC research

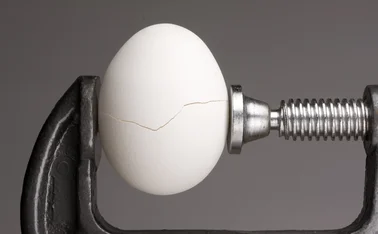

By transacting abnormally in times of market stress, hedge funds can reduce liquidity

Hedge funds can amplify market stress in turbulent times, researchers with the Bank of Canada find in a new research note.

“Hedge funds can at times amplify declines in market liquidity,” say Jabir Sandhu and Rishi Vala. Such funds normally trade in the opposite direction to other market participants, helping to act as a counterbalance.

But the authors found hedge funds began to sell bonds during the market turmoil of March 2020, just as other investors did the same. Instead of providing

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: http://subscriptions.centralbanking.com/subscribe

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@centralbanking.com

Most read

- Trends in reserve management 2024: survey results

- People: RBI appoints senior officials

- China to start selling ultra-long term sovereign bonds